Understanding Why Interest Rates Impact Buyer Activity in the Market

By Erin Wright and Christina Waterhouse

Last week we reviewed the overall Real Estate Market in Clark County since the start of the pandemic. This week we are looking deeper into why interest rates are impacting buyer activity.

Interest Rates, Buying Power, & Inventory

Home buyers have seen historically low interest rates since the end of the Great Recession, between 3% and 5% roughly, compared to the average mortgage interest rate over the last 50 years of 7.91%.[1]

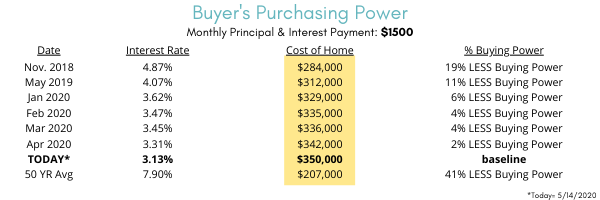

Since the start of the current pandemic, interest rates have continued to lower. The rate as of today (Thursday, May 14, 2020) is 3.13%.[2] In the chart below, you see that even the small changes in interest rates from about 18 months ago until today make a big impact on buying power. This is crucial because in a market like Clark County where there is a housing crisis due to the rapidly rising cost of real estate, more buying power opens up more inventory. Just since the start of 2020, Buyers looking for a $1,500 payment a month for principal and interest (not including taxes and insurance) saw their borrowing power increase from $329,000 to $350,000. To showcase how this impacts their choices, we ran a search on Redfin for a detached, single family home in Clark County. There are currently 28 houses listed for sale up to the price of $325,000. When we move that budget up to $350,000, there are 80 houses listed for sale. Just that $25,000 increase in budget, returned 3x the inventory on the market.

Interest Rates and Monthly Payments

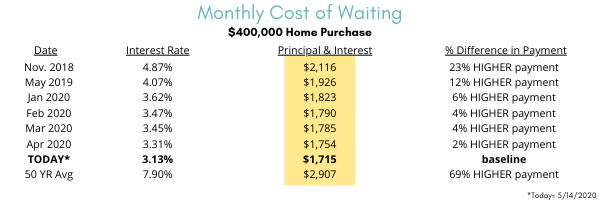

Let’s also look at how the interest rate impacts a monthly payment and therefore a buyer’s monthly budget. In the chart below, you can see how the interest rate would impact a monthly payment for principal and interest (not including taxes and insurance) if a buyer purchased a house at an interest rate from 18 months ago, the beginning of this year, and today. There is a 23% difference in the monthly payment from the most recent high interest rate in November 2018 vs the interest rates today. For a $400,000 house, that equates to an extra $400 a month. This is important because even though some buyers are qualified to purchase a house, they do not feel comfortable spending more than a certain amount per month on their housing. With the interest rate saving $100’s of dollars a month, new buyers will be able to feel comfortable entering the market.

With Buyers able to enter the marketplace and have more buying power since the start of the pandemic, there is still a demand to purchase real estate. As we discussed last week, this demand mixed with fewer new listings coming on the market that would typically be seen this time of year has led to a strong Sellers’ market. The current demand mixed with the lower supply has kept prices stable even during a pandemic with high unemployment.

Mortgage insight and references provided by: Mathew Mattila, Cascade Northern Mortgage: https://www.mathewmattila.com/

As always, we welcome any questions you may have and are happy to offer advice.

[1] History of Monthly Interest Rates According to Freddie Mac: http://www.freddiemac.com/pmms/pmms30.html

[2] Daily Interest Rates According to Mortgage News Daily: http://www.mortgagenewsdaily.com/data/30-year-mortgage-rates.aspx

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link